No one ever expects they will get divorced, be it in Thailand or anywhere else in the world. But “life happens” and relationships do sometimes change to a point where a marriage can no longer be salvaged. If this happens, it is important to know what rights you have and what actions you can take. This is an overview of how divorce in Thailand is handled.

Who can get divorced in Thailand?

Marriages registered in Thailand

If you were married in Thailand and registered your marriage at a local District Office, then you can get divorced in Thailand. This applies whether you or your spouse is a Thai citizen or a foreigner. If all aspects surrounding your decision to end your marriage are amicable and agreed, it is a fairly simple and straightforward process to register such an uncontested divorce, including the terms of the divorce, by filing the relevant paperwork at the District Office where you were married. If, however, there is a dispute, you will have to file for divorce at Family Court where you will be given the opportunity to undergo a mediation, and ultimately, if the parties are still unable to resolve their differences, the court will issue its judgement, including setting the terms of the divorce.

Marriages registered outside of Thailand

If your marriage is registered in another country, you may still be able to get divorced in Thailand. In order to do so, the country where you were married must recognize divorces (there are countries, like the Philippines, that do not), and at least one spouse must be a legal resident in Thailand. As a foreigner, that means living in Thailand on a valid, non-immigrant (not tourist) visa or having permanent resident status. Normally in this case, regardless of whether your divorce is consensual or contested, you would have to file your divorce with the Family Court in Thailand.

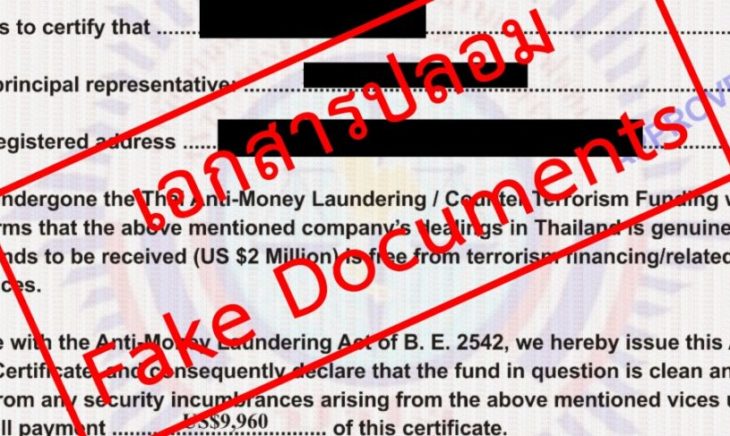

A word of caution: Some “experts” advise married couples registered in another country to register their marriage in Thailand. The idea is to then divorce at the District Office and avoid going to Family Court. This misplaced advice is arguably risky for all parties involved. Some countries may not recognize a “District Office” divorce in instances where the marriage was not originally registered in Thailand. GPS Legal does not recommend this practice.

What if the divorce is consensual, even amicable but you disagree on the terms?

You and your spouse may agree that a divorce is necessary and even agree that you want to avoid going to court. Because by going to court, you both give up a good deal of control over the outcome. Even with that said, it doesn’t necessarily mean you both agree on how to resolve all the various issues in a divorce. As an alternative to court, you may wish to consider a Collaborative Divorce Participation Agreement (CDPA), a dispute resolution method that includes a strong, built-in incentive to compromise and find terms that you both can live with.

Simply put, you and your lawyer, along with your spouse and his/her lawyer, agree to disclose all relevant information (finances, etc.), to listen to each other’s demands and concerns, and to negotiate in good faith until you reach a mutually agreed upon settlement. How is this different from agreeing to a regular mediation or settlement negotiation? With a CDPA, you’re both contractually obligated to take part in a cooperative, non-combative process to avoid going to court.

The incentive of a CDPA is that ultimately, if you are unable to come to an agreement and either side elects instead to go to court, both attorneys must withdraw. You may no longer use those lawyers that have been representing you through the collaboration process. Why is this important? You both will have to start from scratch with new attorneys, which means a longer process and, more than likely, even more legal fees.

Are there other options to divorce?

Whether or not your marriage is registered in Thailand, there are other options available before legally terminating your relationship. You may wish to consider a separation agreement or a post-nuptial contract to set boundaries, rights, and obligations or pre agree on how to later dissolve the marriage if it comes to that. If you have children, there are custody and co-parenting agreements you can put in place. Having a written contract or agreement may not be romantic, but it worth considering as an alternative if both sides wish to try and avoid divorce or the nastiness that can often accompany it.

If your marriage is registered in Thailand, these contracts are available, but with a caveat. Thai law gives marriage special status, especially when it comes to contracts. Section 1469 of Thailand’s Civil and Commercial Code allows either spouse to void any contract between a married couple at any time and without having to give a reason. So, if you and your spouse sign a co-parenting agreement while you’re married, either of you can legally tear it up without cause. And you will have no grounds to contest your spouse’s action. Furthermore, if you enter into these agreements while you are married then get a divorce, you and your now ex-spouse can still void those contracts up to one year after the divorce. There are exceptions to this, for instance pursuing a court-ordered separation, or where a contract is governed and interpreted by jurisdictions other than Thailand, provided you are willing to seek enforcement in those jurisdictions.

Let GPS Legal help you through this difficult time

We know that ending a marriage can be difficult even when both sides agree to do so. And when the couple are not in agreement regarding sensitive issues of child custody, the division of marital assets, or even the divorce itself, it can make a difficult experience traumatic, particularly if you are not in your home country. GPS Legal has assisted many spouses and partners handle their marriage, divorce, and custody matters successfully.

If you are concerned about your marriage or family welfare and would like to find out what you can do, contact GPS Legal today for a confidential consultation. We will explain your options very clearly and carefully so that you can make an informed decision.